To be entitled to receive advance payments of the tax credit for childcare expenses for the 2016 taxation year, you must meet the following requirements: You are (or are the spouse of) the biological or adoptive mother or father (legally or in fact) of a child living with you at the time of application. You must be resident in Québec …

Read More »What’s New for 2015 Income Tax From CRA

We list the service enhancements and major changes below, including announced income tax changes that are not yet law at the time of printing. If they become law as proposed, they will be effective for 2015 or as of the dates given. For more information about these changes, see the areas outlined in the General Income Tax and Benefit Guide – …

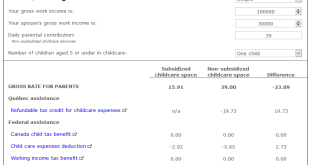

Read More »Childcare Expense Changes in Quebec

Parents with young children often need to start registering their children at various daycare centers (sometimes even before the child is born) just to secure a spot at a CPE to avoid paying $40 a day in childcare expense at a private daycare provider (where daycare spots are more readily available than a CPE, but you will still need to do …

Read More » ReFocusTax.ca Canadian Income Taxes DIY

ReFocusTax.ca Canadian Income Taxes DIY