If you have reported rental income (or loss) on your 2014 Quebec tax return, you should probably have already received a letter from Revenue Quebec asking you to prepare the RL-31 Slip. If not, you can refer to the Revenue Quebec website where you can find all the information you need. In the paragraphs below, you can find the most basic …

Read More »Childcare Expense Changes in Quebec

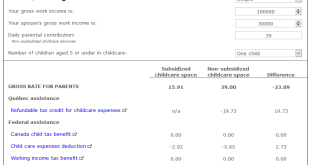

Parents with young children often need to start registering their children at various daycare centers (sometimes even before the child is born) just to secure a spot at a CPE to avoid paying $40 a day in childcare expense at a private daycare provider (where daycare spots are more readily available than a CPE, but you will still need to do …

Read More »Residential Rental Property Owners: New RL-Slip Required

RL-31 slip: Information About a Leased Dwelling As of the 2015 taxation year, any person or partnership that owns a residential complex with one or more leased dwellings must file an RL-31 slip with us and issue an RL-31.CS slip to every individual who is a tenant or subtenant of a leased dwelling on December 31, 2015. Purpose of the RL-31 …

Read More » ReFocusTax.ca Canadian Income Taxes DIY

ReFocusTax.ca Canadian Income Taxes DIY