Parents with young children often need to start registering their children at various daycare centers (sometimes even before the child is born) just to secure a spot at a CPE to avoid paying $40 a day in childcare expense at a private daycare provider (where daycare spots are more readily available than a CPE, but you will still need to do some research and make a few phone calls). Some changes in the daily childcare costs in the 2015 Quebec budget might make that disappear!

Changes in childcare rates according to net family income will come into force on April 22, 2015. The $7.30 per day rate for families with incomes under $50 000 will remain unchanged. The rate will rise to $8 per day on incomes of $50 000 or more. On incomes of $75 000 or more, the daily rate will gradually increase to reach $20.00 per day on incomes of roughly $155 000.

The basic rate of $7.30 will be payable directly to the subsidized childcare provider and the additional contribution according to family income will be payable on the income tax return.

For example, a couple with equal work incomes totalling $100 000 will pay $11.41 per day for childcare. They will pay $7.30 per day to the daycare centre and the additional contribution of $4.11 when they file their income tax return. (Source: Finances Quebec)

It’s important to note that the changes already took effect at as April 22, 2015, rather than as reported by some as Jan 1, 2016.

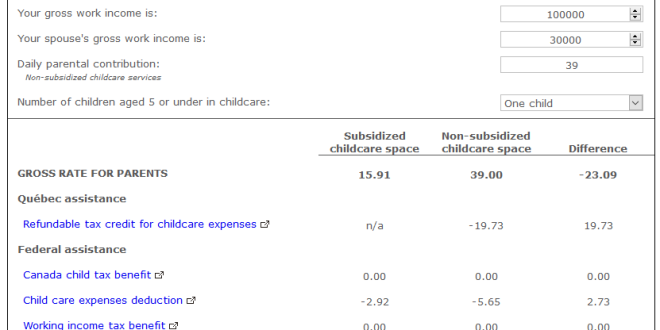

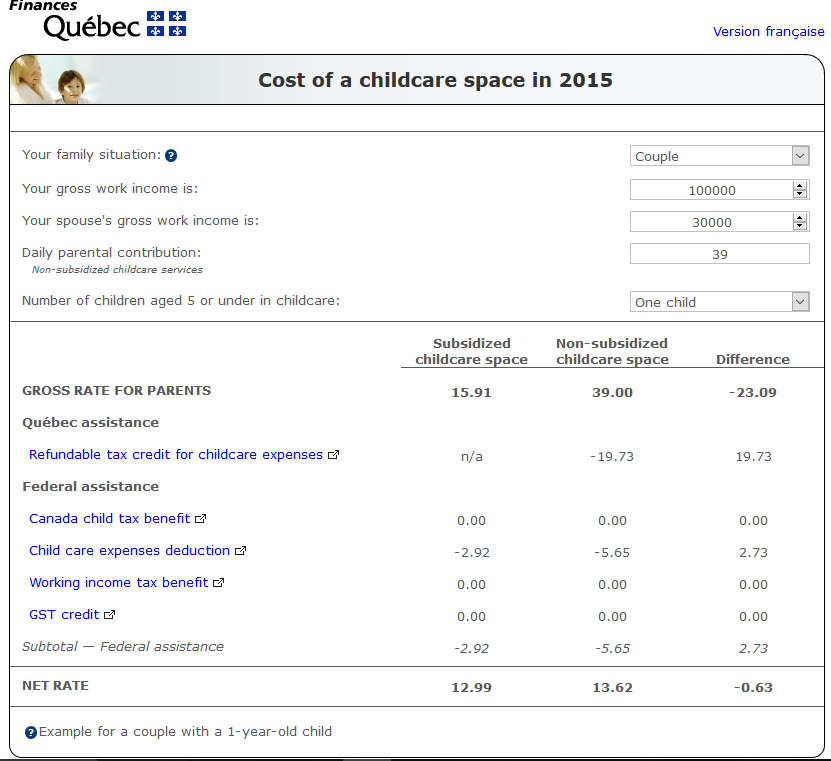

Finances Quebec has made available a tool since April 21, 2015 for parents to calculate the real cost of a childcare spot, subsided or private non-subsided.

As an example, if a couple who pays $39 a day for their only child makes $130,000 gross a year, the real cost of a daycare spot will be pretty much the same whether the child goes to a subsided daycare center or private daycare, as is illustrated by the printscreen below.

If you happen to be a parent who goes out of your way just to send your kid to a CPE every morning, instead of paying a private daycare which is just 100 meters from your home and looks cleaner than your child’s daycare, you might want to reconsider your decision.

Tax Planning Tips:

The real cost of a childcare space is determined by the family income for Quebec provincial income tax purposes, while the child care expenses deduction for federal income tax is normally claimed by the parent with the lower income. As a result, two couples with the same gross family income might end up paying different childcare fees.

Generally speaking, if the two parents have similar income, they would save more from child care expenses deduction than if one parent makes substantially more than the other. There is always an exception to a rule. If one parent goes to school full-time and all or substantially all income comes from the other parent, the higher income parent will be able to claim the child care expenses. The higher the income of the higher income parent, the greater the savings.

ReFocusTax.ca Canadian Income Taxes DIY

ReFocusTax.ca Canadian Income Taxes DIY