“Totally Inadequate Retirement Savings” Broadbent Institute, an Ottawa-based think tank, issued a report recently claiming that the great majority of members of the 55 to 64 age group without an employer pension plan have “totally inadequate retirement savings” and that 11.1% of Canadians aged 65 and over lived in poverty in 2013. The author suggests increasing the GIS, or Guaranteed …

Read More »Do You Need To File A Tax Return?

Ever wondering if you should find some time on your busy schedule to file a tax return which might cost you some time or money? Is it worth it? The following points might help you make the decision. You must file a return for 2015 if any of the following situations apply: You have to pay tax for 2015; Canada …

Read More »RL-31 Slip – Information About a Leased Dwelling

If you have reported rental income (or loss) on your 2014 Quebec tax return, you should probably have already received a letter from Revenue Quebec asking you to prepare the RL-31 Slip. If not, you can refer to the Revenue Quebec website where you can find all the information you need. In the paragraphs below, you can find the most basic …

Read More »Quebec Tax Credit For Childcare Expenses

To be entitled to receive advance payments of the tax credit for childcare expenses for the 2016 taxation year, you must meet the following requirements: You are (or are the spouse of) the biological or adoptive mother or father (legally or in fact) of a child living with you at the time of application. You must be resident in Québec …

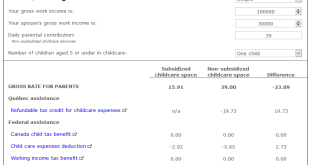

Read More »Childcare Expense Changes in Quebec

Parents with young children often need to start registering their children at various daycare centers (sometimes even before the child is born) just to secure a spot at a CPE to avoid paying $40 a day in childcare expense at a private daycare provider (where daycare spots are more readily available than a CPE, but you will still need to do …

Read More »Registered Retirement Savings Plan (RRSP)

RRSP An RRSP is a retirement savings plan that an individual taxpayer establishes, that Canada Revenue Agency registers and to which the taxpayer or the taxpayer’s spouse or common-law partner contributes. Deductible RRSP contributions can be used to reduce the taxpayer’s income tax payable. Any income earned in the RRSP is usually exempt from tax as long as the funds remain in the plan; …

Read More »Moving Expenses Deduction

Who can claim moving expenses? If you have moved and established a new home to work or to run a business at a new location, you can claim eligible moving expenses. You can also claim moving expenses if you moved to take courses as a student in full-time attendance enrolled in a post-secondary program at a university, college, or other educational …

Read More »Tax-Free Savings Account

Tax-Free Savings Account (TFSA), or le compte d’épargne libre d’impôt (CELI) in French. Any Canadian resident who is 18 years and older with a valid social insurance number, can set aside money that can grow tax-free throughout their lifetime. Unlike an RRSP, contributions to a TFSA are not tax deductible. In other words, contributions to a TFSA are made with after-tax …

Read More » ReFocusTax.ca Canadian Income Taxes DIY

ReFocusTax.ca Canadian Income Taxes DIY